Cornerstone Properties2013 Interactive Annual Report

NOTE: Reserves, estimated production and mine start-up information for all of the following properties were provided by the operators and have not been verified by Royal Gold. Metal prices for the reserve figures can be found on Producing Properties table, footnote # 2.

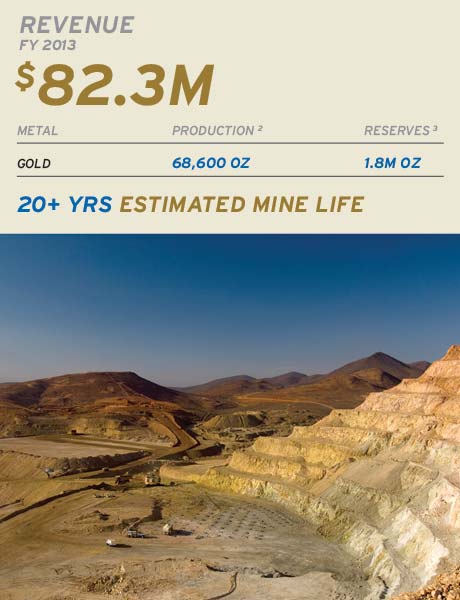

Andacollo

Year-over-year production increased by about one-third.

Royal Gold owns a net smelter return (“NSR”) royalty equal to 75% of all gold produced from the sulfide portion of the deposit until 910,000 payable ounces have been sold, and 50% of the payable gold thereafter. 1 The Andacollo operation is a surface copper mine operated by a subsidiary of Teck Resources Limited (“Teck”). Gold is produced as a by-product of copper production. The mine is located in Chile’s Region IV, approximately 35 miles southeast of La Sarena and 220 miles north of Santiago.

Royal Gold owns a net smelter return (“NSR”) royalty equal to 75% of all gold produced from the sulfide portion of the deposit until 910,000 payable ounces have been sold, and 50% of the payable gold thereafter. 1 The Andacollo operation is a surface copper mine operated by a subsidiary of Teck Resources Limited (“Teck”). Gold is produced as a by-product of copper production. The mine is located in Chile’s Region IV, approximately 35 miles southeast of La Sarena and 220 miles north of Santiago.

Production Status: Year-over-year production increased by about one-third largely due to higher mill throughput and higher grades of ore. Mill throughput averaged approximately 47,000 tonnes per day during the fourth quarter of fiscal 2013. Teck’s full-year calendar 2013 guidance is 63,000 ounces due to mining of lower grade material in the second half of the year.

- There have been approximately 167,000 cumulative payable ounces produced as of June 30, 2013.

- Reported production for FY2013 relates to the amount of metal sales subject to our royalty interests as reported to us by the operator of the mine.

- Reserves as of December 31, 2012.

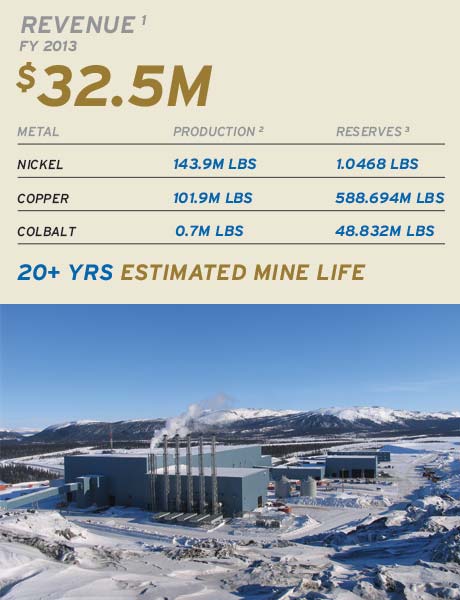

Voisey's Bay

Voisey’s Bay operated at steady state production during fiscal 2013

Royal Gold holds a 2.7% NSR royalty on all metals from the Voisey’s Bay mine operated by Vale Inco (“Vale”). Voisey’s Bay is a surface nickel-copper-cobalt mine located in northern Labrador, about 20 miles southwest of the town of Nain and 50 miles northwest of Natuashish.

Royal Gold holds a 2.7% NSR royalty on all metals from the Voisey’s Bay mine operated by Vale Inco (“Vale”). Voisey’s Bay is a surface nickel-copper-cobalt mine located in northern Labrador, about 20 miles southwest of the town of Nain and 50 miles northwest of Natuashish.

Production Status: In late March 2013, the Government of Newfoundland and Labrador announced amendments to their Voisey’s Bay Development Agreement including a commitment from Vale to pursue underground mining to extend the mine life. The agreement also allows Vale to continue processing concentrate outside of the province while construction is being finalized at the Long Harbour hydromet processing facility.

- Revenues consist of provisional payments for concentrates produced during the current period and final settlements for prior production periods.

- Reported production for FY2013 relates to the amount of metal sales subject to our royalty interests as reported to us by the operator of the mine.

- Reserves as of December 31, 2012.

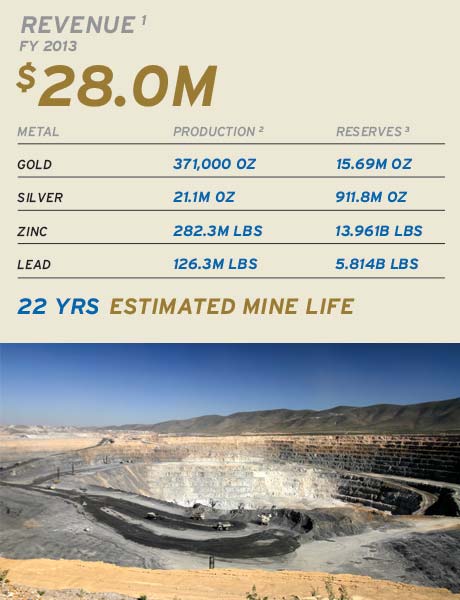

Peñasquito

Goldcorp reported a 26% increase in gold production over the prior fiscal year

Royal Gold owns a 2.0% NSR royalty on all metals at the Peñasquito mine. The surface mine, composed of two main deposits, Peñasco and Chile Colorado, hosts one of the world’s largest gold, silver, and zinc reserves, while also containing large lead reserves. The project is operated by a subsidiary of Goldcorp Inc. (“Goldcorp”) and is located in the state of Zacatecas, approximately 125 miles northeast of the city of Zacatecas and 15 miles south of Concepción del Oro.

Royal Gold owns a 2.0% NSR royalty on all metals at the Peñasquito mine. The surface mine, composed of two main deposits, Peñasco and Chile Colorado, hosts one of the world’s largest gold, silver, and zinc reserves, while also containing large lead reserves. The project is operated by a subsidiary of Goldcorp Inc. (“Goldcorp”) and is located in the state of Zacatecas, approximately 125 miles northeast of the city of Zacatecas and 15 miles south of Concepción del Oro.

Production Status: Goldcorp reported a 26% increase in gold production over the prior fiscal year, while production of silver, zinc and lead decreased by modest amounts. Goldcorp’s annual CY2013 production guidance anticipates increased production for the first half of fiscal 2014 as the mine moves from lower grade to higher grade ore. In the fourth quarter the sulfide plant achieved throughput of 105,000 tonnes per day following the completion of crusher maintenance, blasting

- Reported production for fiscal 2013 relates to the amount of metal sales subject to our royalty interests as reported to us by the operator of the mine.

- Reserves as of December 31, 2012.

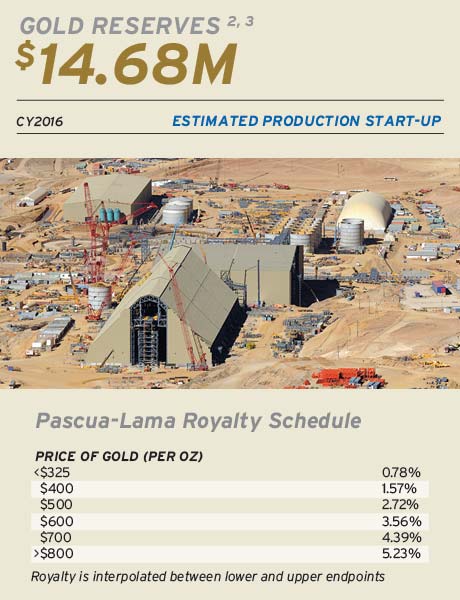

Pascua-Lama

Pascu-Lama is a world class asset with a long estimated mine life and low estimated cash costs.

Royal Gold owns a 0.78% - 5.23% sliding-scale NSR royalty 1 on the Pascua-Lama project which is operated by a subsidiary of Barrick Gold Corporation (“Barrick”). This royalty is applicable to all gold production from an area of interest in Chile. Royal Gold also holds a 1.05% NSR copper royalty which applies to all of the copper reserves in Chile within the area of interest, and takes effect after January 1, 2017. The Pascua-Lama project is being developed as a surface mine and is located on both sides of the border between Argentina and Chile, approximately 95 miles southeast of Vallenar, Chile and approximately 185 miles northeast of San Juan, Argentina.

Construction Status: In July 2013, Barrick reported that construction activities have been deferred until the project’s water management system has been completed to the satisfaction of Chile’s Environmental Superintendent. Barrick estimates that the system will be in compliance with permit conditions by the end of calendar 2014. After this, they expect to complete the remaining construction works in Chile, including pre-stripping. They also intend to re-sequence construction of the process plant and other facilities in Argentina in order to target first production by mid calendar 2016.

Barrick estimates that capital costs will be in the range of approximately $8.0 to $8.5 billion. As of June 30, 2013, approximately $5.4 billion has been spent on the project. Barrick’s annual production guidance for the first five years is 800,000 to 850,000 ounces of gold.

- See footnotes 24 to 26 on page 23 of this report.

- Royalty applies to all gold production from an area of interest in Chile. Only that portion of the reserves pertaining to our royalty interest in Chile are reflected here.

- Reserves as of December 31, 2011.

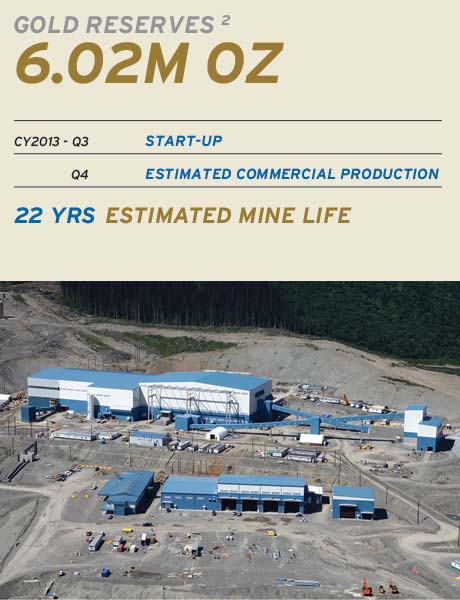

Mt. Milligan

Thompson Creek expects to reach commercial production at Mt. Milligan in the fourth quarter of this calendar year.

Royal Gold owns the right to 52.25% of the payable gold from the Mt. Milligan project which is owned by a subsidiary of Thompson Creek Metals Company (“Thompson Creek”). In addition to Royal Gold’s upfront payments to acquire this metal stream, the Company will make cash payments to Thompson Creek at a fixed price of $435 for each ounce of gold delivered to Royal Gold. 1 Mt. Milligan is a surface copper-gold mine located in central British Columbia, Canada, approximately 95 miles northwest of Prince George.

Royal Gold owns the right to 52.25% of the payable gold from the Mt. Milligan project which is owned by a subsidiary of Thompson Creek Metals Company (“Thompson Creek”). In addition to Royal Gold’s upfront payments to acquire this metal stream, the Company will make cash payments to Thompson Creek at a fixed price of $435 for each ounce of gold delivered to Royal Gold. 1 Mt. Milligan is a surface copper-gold mine located in central British Columbia, Canada, approximately 95 miles northwest of Prince George.

Construction Status: In mid-August, Thompson Creek reported that the phased start-up had begun with the first feed to the concentrator. In late September, they announced the commencement of copper-gold concentrate production. Routine testing and commissioning of the equipment and process circuits will continue through the start-up period. Thompson Creek expects to reach commercial production at Mt. Milligan in the fourth quarter of this calendar year and estimates that annual gold production will average 262,000 ounces over the first six years.

- This is a metal stream whereby the purchase price for each gold ounce delivered is $435 or the prevailing market price of gold, if lower; no inflation adjustment.

- Reserves as of October 2009.