Twenty-five years ago, we created a bank that lived entirely online. Some called it a crazy idea, but our team knew — and our customers soon realized — we had created a better way to bank. The journey has been exhilarating, filled with many more highs than lows, and one in which I am most fortunate to continue to participate.

Reflecting on our 25 years of reimagining banking, what stands out is the unwavering resilience our team has displayed in response to market-shaking events. Since First Internet Bank’s inception in 1999, we have weathered the dot-com bubble, the Great Financial Crisis and, most recently, the challenges arising from the global pandemic. In response to these obstacles, we have consistently emerged as a stronger company. Our ability to navigate through times of turmoil is not merely a stroke of good fortune but a result of our steadfast commitment to fundamental banking principles and the entrepreneurial culture that drives our workplace.

During the past year, we faced another round of significant external headwinds resulting from the steepest, fastest Federal Funds rate increase in recent history. The Bank also withstood an industry-wide liquidity scare that shook the financial services sector and culminated in the failure of three prominent banks. Despite these challenges, we persevered, successfully ending the year on several high notes. And with these external factors likely behind us, we believe First Internet Bank is well-positioned as we enter our second 25 years.

Over the past two years, we have steadfastly worked to transform and optimize our loan portfolio composition. We are now beginning to show meaningful progress and early signs of tangible financial benefits, including improved returns for shareholders. Buoyed by a strong balance sheet and capital levels, outstanding asset quality and an energized team of innovative thinkers, we are now poised for higher profitability and greater revenue growth — with or without anticipated Federal Reserve rate cuts.

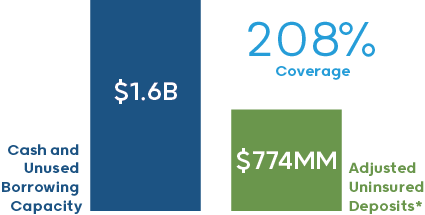

In 2023, despite an industry-wide liquidity crunch, we achieved a record $4.1 billion in total deposits, marking an 18 percent increase from 2022. Our loan balances also grew, totaling $3.8 billion by the end of the year, representing a 10 percent increase over the previous year. Total assets reached $5.2 billion at year end. Notably, we were one of the few banks to grow tangible book value per common share for the year, increasing it to $41.43 as of December 31, 2023, up from $39.74 as of December 31, 2022. And with $1.6 billion in cash and unused borrowing capacity, our liquidity remains strong while our exposure to uninsured deposits is well below that of most banks.

* Represents total uninsured deposits less Indiana-based public funds and certain deposits under contractual agreements.

Our strategy to reposition the bank’s balance sheet yielded solid production in both construction and franchise finance lending. Additionally, our continued focus on small business has resulted in exceptional performance, as evidenced by our position as a top-ten Small Business Administration (SBA) 7(a) lender. Our nationwide platform provides growth capital to business owners, reinforcing our enduring commitment to entrepreneurship. In 2023, First Internet Bank’s SBA lending team achieved a 139 percent increase in origination volumes over the prior year and generated over $20 million in gain on sale revenue, reflecting an increase of over 80 percent from 2022.

To better serve our small business customers, we enhanced our Do More Business™ Checking solution by adding new functionality to the already benefit-rich account. Balance Optimizer enables business owners to seamlessly move money between First Internet Bank accounts to earn a higher rate of interest on their cash balances, and Cash Flow Analysis provides automated cash flow forecasting and digital insights that help owners make better business decisions.

Entrepreneurs make dozens of business decisions every day; some are small, some are dizzying. The decision to launch a direct-to-consumer bank in the days when internet connectivity was measured in minutes and cell phones did little more than make phone calls... well, that was a big leap. Now, as we celebrate our 25-year anniversary, I’m proud to note the foundational tenets that inspired me to launch the bank continue to inform and shape our company today: innovation, adaptability, technical savvy, and our ability to IMAGINE MORE. These principles help ensure we deliver financial products and creative solutions to the marketplace and further cement our position as an industry leader.

To those who began this journey with me, to those who recently joined us, I am deeply grateful for your resolute and tireless efforts in the face of adversity. On behalf of all team members, our leadership team and our Board of Directors, I would also like to thank our shareholders for their support as we continue to cultivate a better banking experience for our customers.

DAVID B. BECKER

Chairman and

Chief Executive Officer