2014 Interactive Annual Report

2014 Interactive Annual Report

The Company considers both historical and future potential revenues in determining which interests in our portfolio are principal to our business. Estimated future potential revenues from both producing and development properties are based on a number of factors, including reserves subject to our royalty interests, production estimates, feasibility studies, metal price assumptions, mine life, legal status and other factors and assumptions, any of which could change and could cause the Company to conclude that one or more of such interests are no longer principal to our business.

We also have a principal development property, which is a 0.78% to 5.23% sliding-scale NSR royalty on Barrick’s Pascua-Lama project that straddles the border between Argentina and Chile. Our royalty interest is applicable to all gold production from the portion of the Pascua-Lama project lying on the Chilean side of the border. Pascua-Lama is one of the world’s largest gold and silver deposits with 15 million ounces of proven and probable gold reserves subject to our interests. During the fourth quarter of calendar 2013, Barrick announced the temporary suspension of construction at Pascua-Lama, except for activities required for environmental and regulatory compliance.

NOTE: Reserves, estimated production and mine start-up information were provided by the operators and have not been verified by Royal Gold. Metal prices for the reserve figures can be found on Producing Properties table, footnote # 3.

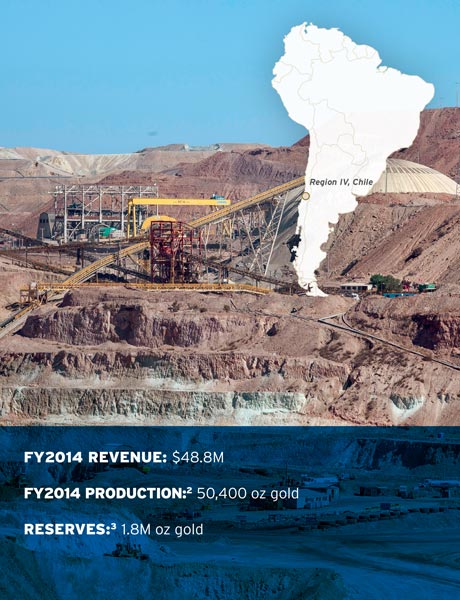

Andacollo

Royal Gold owns a net smelter return (“NSR”) royalty equal to 75% of all gold produced from the mine until 910,000 payable ounces have been sold, and 50% of the payable gold thereafter.1 Andacollo is an open-pit copper mine and milling operation operated by a subsidiary of Teck Resources Limited (“Teck”). Gold is produced as a by-product of copper production. The mine is located in Coquimbo Province, Region IV, Chile, adjacent to the town of Andacollo.

Production Status: Year-over-year production decreased approximately 27% due to lower grades, as expected in the mine plan. Mill throughput averaged approximately 51,000 tonnes per day during the fourth quarter of fiscal 2014. Teck’s full-year calendar 2014 guidance is 38,500 payable ounces.

- As of June 30, 2014, approximately 217,000 payable ounces of gold have been sold.

- Reported production for FY2014 relates to the amount of metal sales subject to our royalty interests as reported to us by the operators of the mines.

- Reserves as of December 31, 2013.

Peñasquito

Royal Gold owns a 2.0% NSR royalty on all metals at the Peñasquito mine. The open-pit mine, composed of two main deposits, Peñasco and Chile Colorado, hosts one of the world’s largest gold, silver, and zinc reserves, while also containing large lead reserves. Peñasquito is operated by a subsidiary of Goldcorp Inc. (“Goldcorp”) and is situated in the western half of the Concepción Del Oro district in the northeast corner of Zacatecas State, Mexico.

Production Status: Gold production at Peñasquito increased approximately 44% and reported production for silver, lead and zinc also increased over the prior fiscal year. Goldcorp reported that it is mining in the higher grade portion of the pit, which is expected to continue throughout calendar 2014. Goldcorp’s full-year calendar 2014 guidance is between 530,000 and 560,000 ounces of gold.

- Reported production for FY2014 relates to the amount of metal sales subject to our royalty interests as reported to us by the operators of the mines.

- Reserves as of December 31, 2013.

Mt Milligan

Royal Gold’s wholly-owned subsidiary owns the right to purchase 52.25% of the payable gold from the Mt. Milligan project, at a cash purchase price of $435 for each payable ounce of gold delivered to Royal Gold.1 Mt. Milligan is an open-pit copper-gold mine located in central British Columbia, Canada and operated by a subsidiary of Thompson Creek Metals Company (“Thompson Creek”).

Production Status: Thompson Creek reported that the mine reached commercial production, defined as operating the mill at 60% of design capacity for 30 days, on February 18, 2014. The ramp-up at Mt. Milligan continues to progress well with grades and metal recoveries as expected, and mill throughput steadily improving. Thompson Creek expects mill throughput will achieve approximately 80% of design capacity by the end of calendar year 2014.

During our fiscal year 2014, we purchased 25,750 ounces of physical gold, which came from a combination of provisional and final settlements associated with the first seven shipments of concentrate from Mt. Milligan. We sold approximately 21,100 ounces of gold during the year at an average price of $1,292 per ounce, and had approximately 7,800 ounces of gold in inventory as of June 30, 2014. Thompson Creek expects Mt. Milligan to produce between 185,000 and 195,000 ounces during the 2014 calendar year.

- This is a metal stream whereby the purchase price for each gold ounce delivered is $435 per ounce, or the prevailing market price of gold, if lower; no inflation adjustment. Payable gold for this stream is set at 97% of the contained ounces in concentrate.

- Reserves as of December 31, 2013.

Royal Gold holds a 2.7% NSR royalty on all metals from the Voisey’s Bay mine operated by a subsidiary of Vale S.A. (“Vale”). Voisey’s Bay is presently a surface nickel-copper-cobalt mine and will transition into an underground operation in the future. The mines is located in northern Labrador, Canada.

Production Status: Nickel production at Voisey’s Bay decreased approximately 14% and copper production decreased approximately 21% compared to the prior fiscal year. Vale reports the decrease in production is due to a combination of items, including a failure in the grinding section of the mill in January 2014, a maintenance stoppage at Sudbury during the June 2014 quarter and decreasing ore grades.

Vale will transition the processing of Voisey’s Bay nickel concentrate from its Sudbury and Thompson smelters to its new Long Harbour Hydrometallurgical Plant.4 Initially, Vale will process a combination of matte from its Indonesian operations and concentrate from Voisey’s Bay, moving to processing solely concentrate from Voisey’s Bay at a later stage.

- Revenues consist of provisional payments for concentrates produced during the current period and final settlements for prior production periods.

- Reported production for FY2014 relates to the amount of metal sales subject to our royalty interests as reported to us by the operators of the mines.

- Reserves as of December 31, 2013.

- In anticipation of the transition from processing Voisey’s Bay nickel concentrates at Vale’s Sudbury and Thompson smelters to processing at the Long Harbour Hydrometallurgical Plant, Royal Gold is engaged in discussions with Vale concerning calculation of the royalty once Voisey’s Bay nickel concentrates are processed at Long Harbour. Vale proposed a calculation of the royalty that Royal Gold estimates could result in the substantial reduction of royalty on Voisey’s Bay nickel concentrates processed at Long Harbour. For further information, see Royal Gold’s Annual Report on Form 10-K.