Nationwide Deposits

As a digital bank, we offer the complete suite of online and mobile banking tools customers need to help them make smart financial choices. With an intuitive online platform and the human touch our relationship bankers deliver, we provide deposit accounts for consumers, small and mid-size business and municipalities.

Residential Mortgage and Home Equity Lending

With an award-winning national online platform for origination in all 50 states, we offer conventional, FHA, VA and jumbo 1-4 family mortgage loans. We also originate home equity loans and lines of credit.

Consumer Lending

By lending directly to consumers, as well as indirectly through an established dealer network, we attract creditworthy customers across the country. We offer loans for a variety of consumer needs with a specialization in recreational vehicle and horse trailer loans.

Small Business Lending

Our Small Business Administration (SBA) lending team has the experience needed to create tailored financial solutions for entrepreneurs and small business owners while delivering future flexibility and payment certainty. Our SBA Preferred Lender status allows us to deliver a faster, streamlined loan process. Spending less time on the loan process means more time for customers to focus on what matters most - growing their business.

CONSTRUCTION AND Commercial Real Estate Lending

We deliver financing solutions for experienced developers and owners of investment property featuring a variety of real estate-oriented loan products. Offerings include construction and development debt capital for office, retail, industrial and multi-family properties. We also finance residential construction and development with homebuilders and developers.

Single Tenant Lease Financing

Acquisition financing is offered nationwide for sophisticated real estate investors introduced to us through our committed, growing network of mortgage bankers, brokers and national correspondents. Properties financed are generally well-located within their respective markets and subject to long-term, net lease arrangements with well-known, global, national or regional brands.

Commercial Banking

We offer customized solutions on business lines of credit, term loans, credit cards and owner-occupied real estate to middle-market companies in Indiana and Arizona. Our comprehensive lineup of online treasury management services allows our clients to run their businesses more efficiently and optimize their cash positions with robust reporting and access capabilities.

Public Finance

We offer a variety of lending and depository solutions for government entities and municipal utilities. Options are available for funding capital projects or refinancing existing debt for schools, hospitals, police and fire departments, development districts and public infrastructure projects.

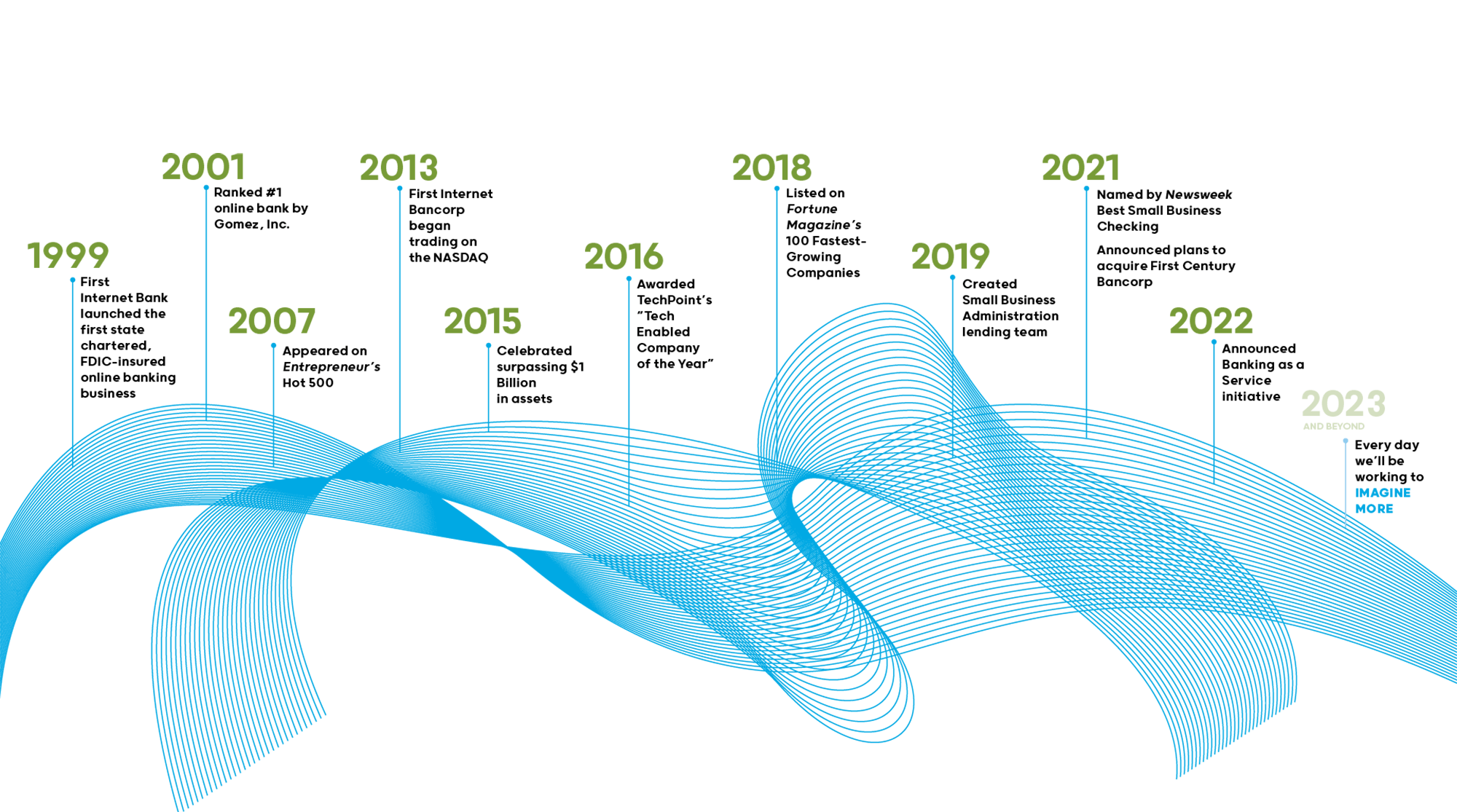

banking as a service

By providing foundational banking infrastructure, we support and help fintech founders bring innovative products to market.