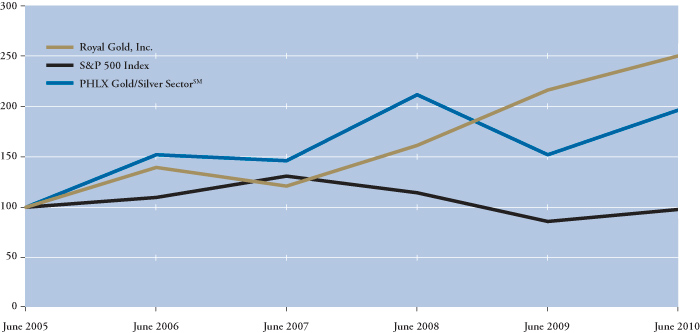

Five-Year Shareholder Return Comparison

The following graph compares the value of the Company’s Common Stock with the value of two stock market indices: Standard and Poor’s 500 Index and the PHLX Gold/Silver Sector IndexSM (XAUSM) as of June 30, 2010. The Company believes that the XAUSM is more representative of the gold mining industry whereas the Standard and Poor’s 500 Index includes only one gold mining company.

Indexed Returns |

Years Ended June 30, | |||||

| Company Name Index | Base Period 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Royal Gold, Inc. | 100 | 139.35 | 120.01 | 159.81 | 214.62 | 248.96 |

| S&P 500 Index | 100 | 108.63 | 131.00 | 113.81 | 83.97 | 96.09 |

| PHLX Gold/Silver Sector | 100 | 151.06 | 145.25 | 212.52 | 151.17 | 194.59 |

1 Includes dividend reinvestment.

The PHLX Gold/Silver SectorSM (XAUSM) is a capitalization-weighted index composed of the following 16 companies engaged in the gold and silver mining industry:

Agnico-Eagle Mines Limited

AngloGold Ashanti Limited - ADR

Barrick Gold Corporation

Compania Minas Buenaventura - ADR

Freeport-McMoRan Copper & Gold

Gold Fields Limited - ADR

Goldcorp Inc.

Harmony Gold Mining Limited - ADR

Kinross Gold Corporation

Newmont Mining Corporation

Pan American Silver Corporation

Randgold Resources Limited - ADR

Royal Gold, Inc.

Silver Standard Resources Inc.

Silver Wheaton Corporation

Yamana Gold, Inc.